Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

Editor’s Note: Every year, Loomis Sayles features outlooks from our sector teams — teams composed of traders, analysts, strategists and portfolio managers immersed in their respective sectors of the fixed income market. We asked each sector team three questions that drill into key themes in their sectors. We will publish views from each sector team over the next few weeks.

To set the stage, we’re starting with Craig Burelle, Senior Macro Strategies Analyst, and his views on the macro backdrop in 2022.

1. Let’s start with a topic dominating the conversation these days—inflation. What’s your view on the path of inflation this year? How do you expect the Federal Reserve to respond?

In our view, much of the inflation debate hinges on whether inflation will ease once supply chain disruptions subside. Very little about 2021 was “normal,” and we believe supply chain disruptions have distorted recent inflation data. With COVID-19 cases surging globally and demand remaining strong, we think supply chain disruptions are likely to linger until the second half of 2022. If these distortions clear up, we expect core PCE inflation to settle into a range between 2.0% and 2.5%.

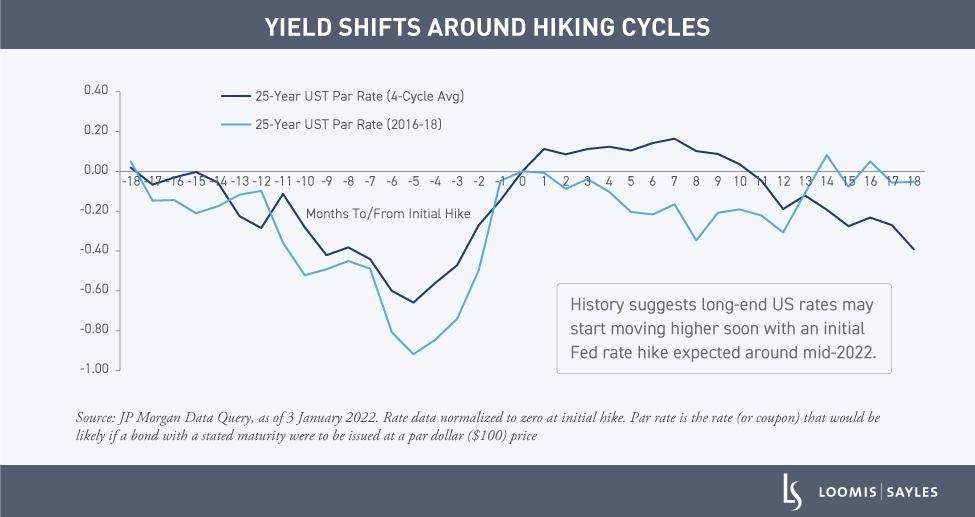

The December FOMC (Federal Open Market Committee) meeting revealed a hawkish pivot in its policy approach. The Fed appeared more concerned that high inflation is no longer transitory and signalled a more aggressive path for policy rates. As a result, we expect the Fed to respond to higher inflation with four rate hikes in 2022, starting near the end of the first quarter.

Going forward, we’ll be watching how inflation trends relative to the Fed’s 2022 core PCE inflation outlook, which is currently at 2.7%. We view this as a critical threshold that could determine how aggressively the Fed hikes rates. If inflation does not start trending down toward 2.7% by the second half of 2022, then we believe the Fed could become significantly more hawkish in 2023.

2. Could a Fed tightening cycle put the global expansion at risk?

We don’t think so. Historically, risk assets have continued to generate positive average total returns as the Fed tightens policy. It’s generally the end of policy tightening when returns start to get shaky.

We see several macro drivers that should help fuel the global expansion for months to come:

That said, investors may want to fasten their seatbelts. Asset valuations are generally rich and we anticipate market swings as the market reprices Fed expectations.

3. Which asset classes are positioned to perform well in this environment?

We think bond investors can seek to harvest carry in this environment. In our view, risk assets can still offer opportunity, particularly among US equities, high yield credit and levered loans. However, we believe security selection will be critical for distinguishing quality securities that could help drive potential alpha.

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.