Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

INTRODUCTION

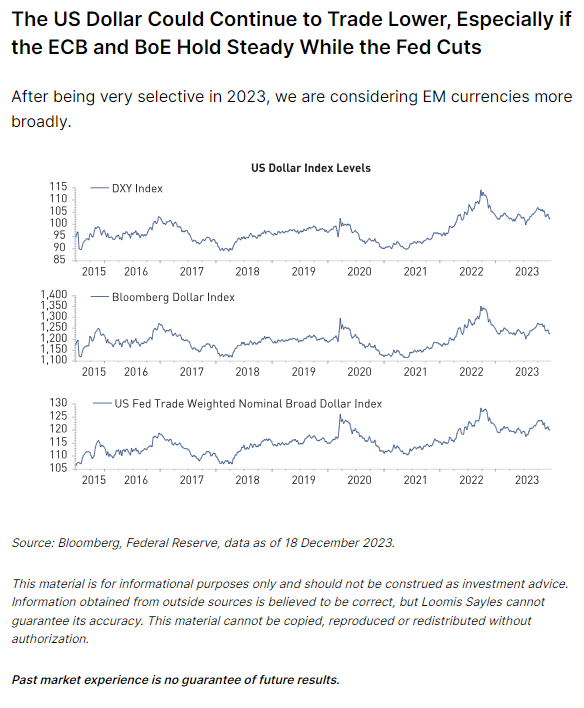

The European Central Bank (ECB) and Bank of England (BoE) seem content to hold policy rates near current levels, even with real growth near 0%. The Federal Reserve (Fed) has indicated rate cuts will likely be its next move. We believe 25 basis point cuts are likely in June, September and December 2024. Our view is less aggressive than what fed funds futures pricing suggests.

The interest rate outlook is a critical driver of our economic and investment views. Globally, monetary policies have been restrictive and growth rates have moved lower. We believe the United States can avoid recession, at least for the next few quarters, but continental Europe may not.

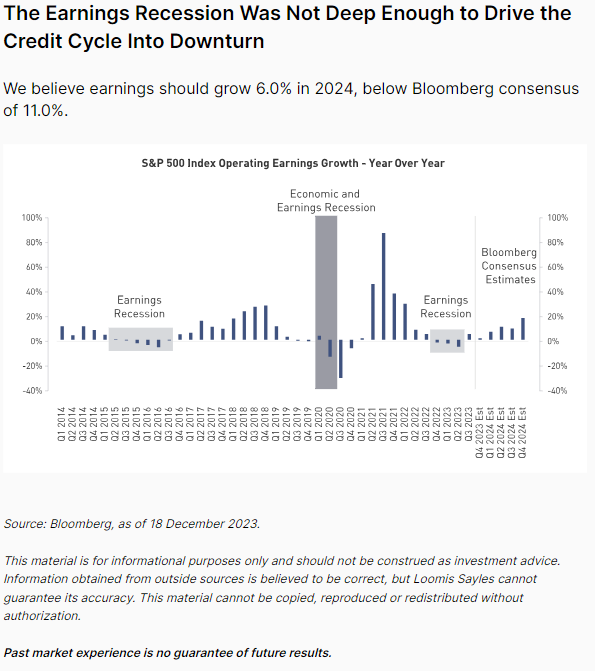

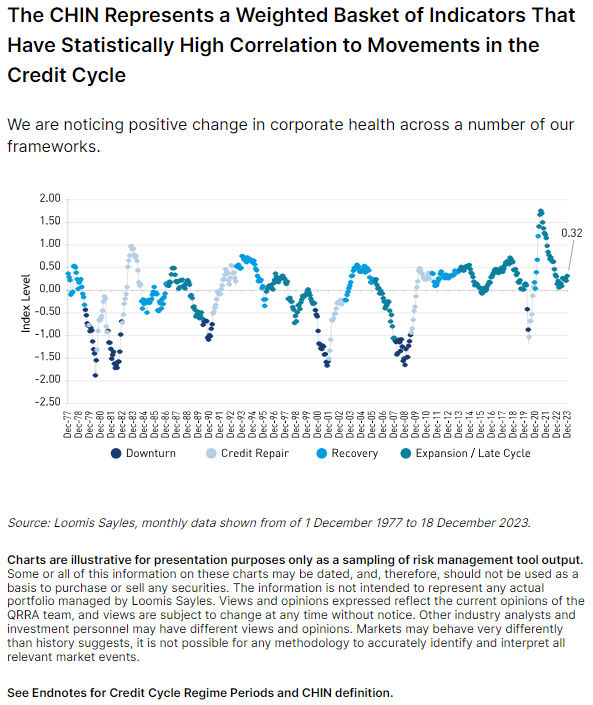

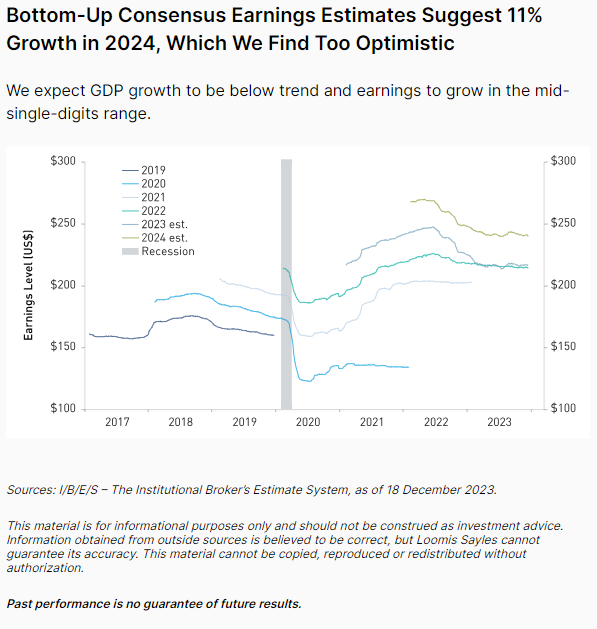

Macro DriversOur core belief is that corporate profits drive the credit cycle. A downturn is less likely now that the US earnings recession is over.

|

|

Corporate Credit

1 Sources: Bloomberg Corporate High Yield Index yield to worst and Bloomberg US Aggregate Corporate Bond Index yield to worst as of 19 December 2023. |

|

Government Debt & Policy

|

|

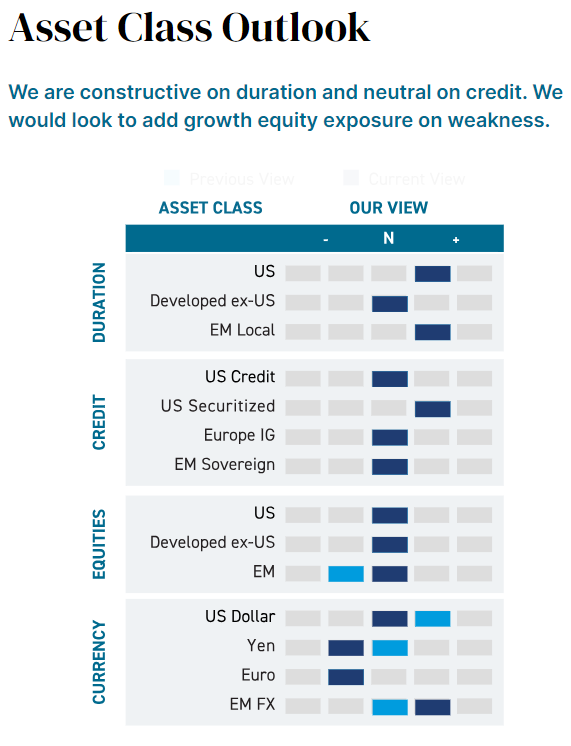

CurrenciesWe anticipate easier financial conditions in the US, especially when the Fed starts to ease interest rates. Typically, such an environment fosters US dollar weakness.

|

|

EquitiesWe believe that a strong recovery in EM earnings could occur after the weak stretch of the past several quarters of 2023.

|

|

Potential RisksWe have grown more optimistic about the economy. Risk assets largely reflect expected economic progress and valuations across most markets have risen.

|

|

Author

Global Macro Strategist, Credit

This article has been prepared and distributed by Natixis Investment Managers Australia Pty Limited AFSL 246830 for the Loomis Sayles Global Equity Fund (the “Fund”) and may include information provided by third parties. The information in this report is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited AFSL 229988 is the responsible entity of the unquoted and quoted class units of the Fund. Loomis Sayles & Company, L.P. is the investment manager.

This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement and Target Market Determination, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. There is no guarantee the performance of the Fund or any particular rate of return. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.