Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

INTRODUCTION

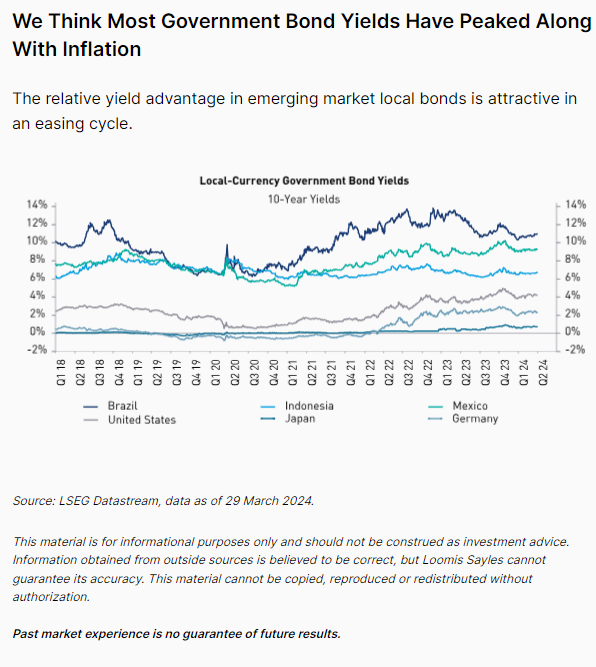

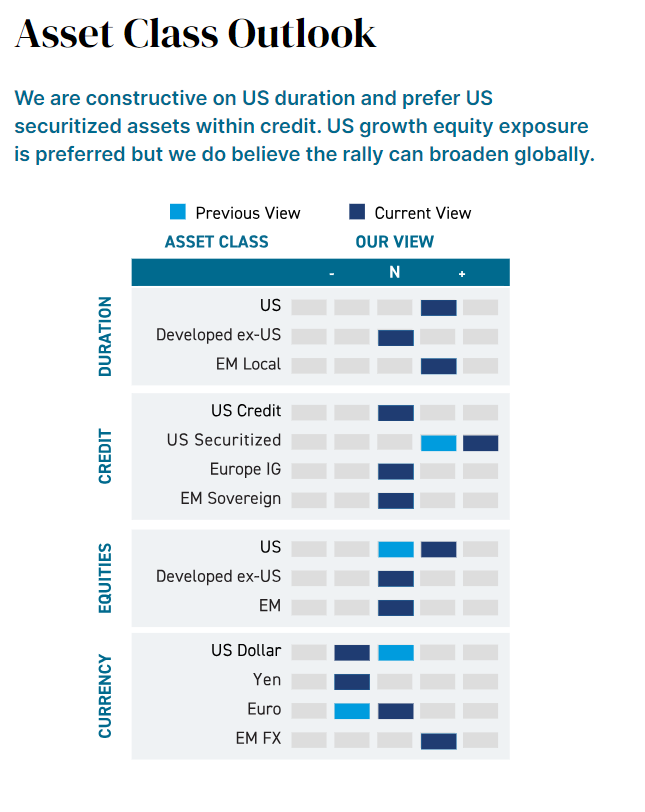

While central banks may not have reached their absolute inflation targets, we feel confident the trend in core inflation is lower from here. Emerging market central banks have been cutting interest rates for some time. Now, developed economy central banks, such as the Swiss National Bank (SNB), are joining in. Additional rate cuts appear to be on the horizon as a global easing cycle begins to broaden out.

We believe the Federal Reserve (Fed) is prepared to lower rates in 2024. Current market pricing of three to four cuts looks appropriate. The European Central Bank (ECB) and Bank of England (BoE) may begin rate cutting cycles as well, but most likely after the Fed begins.

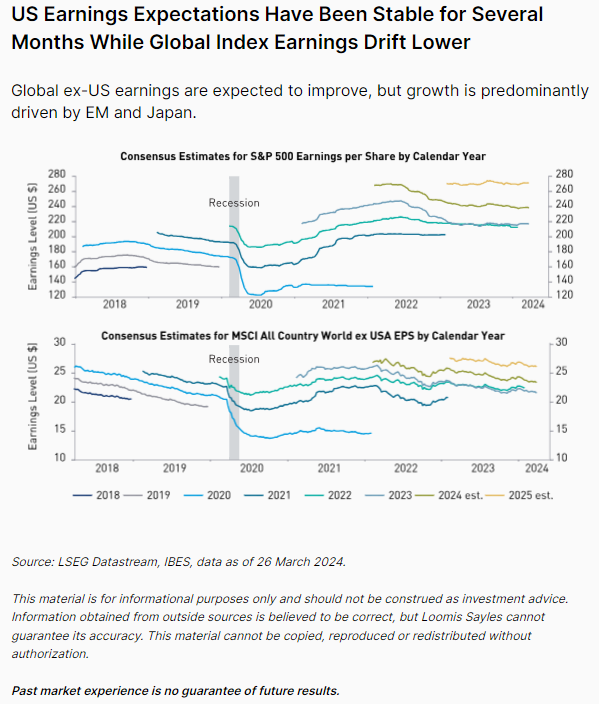

Macro DriversUS corporations are showing leadership, while global market fundamentals look set to bottom soon and improve throughout 2024.

|

|

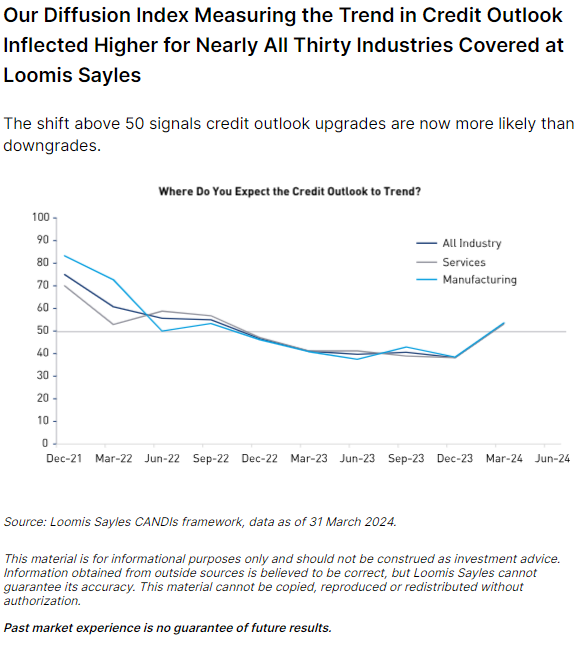

Corporate CreditIn our view, investors should be able to harvest the yield advantage that corporates offer relative to Treasurys but spread compression is less likely.

|

|

Government Debt & PolicyWe believe disinflationary trends are likely to remain in place since global supply chains have normalized and economic growth rates are likely to find long-term trend levels in 2024.

|

|

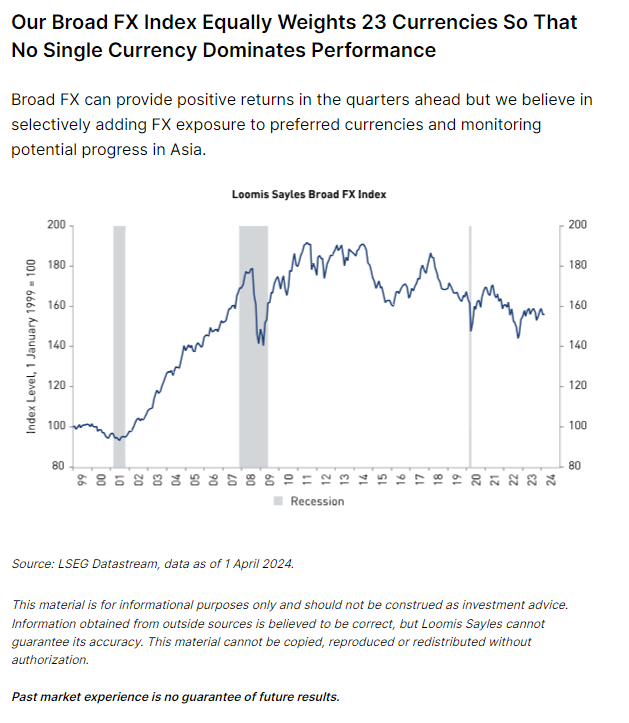

CurrenciesFinancial conditions should remain easy in the US, especially if the Fed is able to cut the fed funds rate by 75 basis points by year-end.

|

|

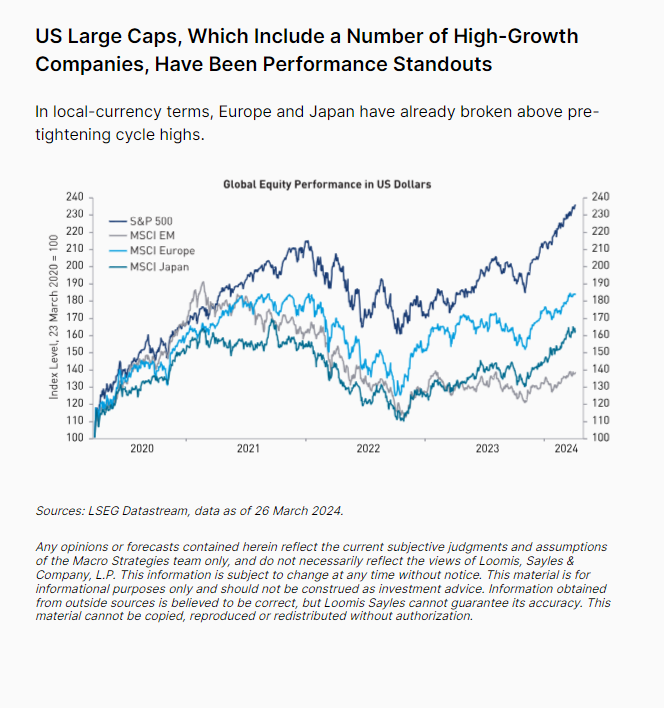

Global EquitiesEarnings growth expectations for Europe are the laggard, but we think valuations on those indices are not rich.

|

|

Potential RisksMost markets are priced for positive developments. We believe that could remain the case over the next quarter.

|

|

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.