Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

INTRODUCTION

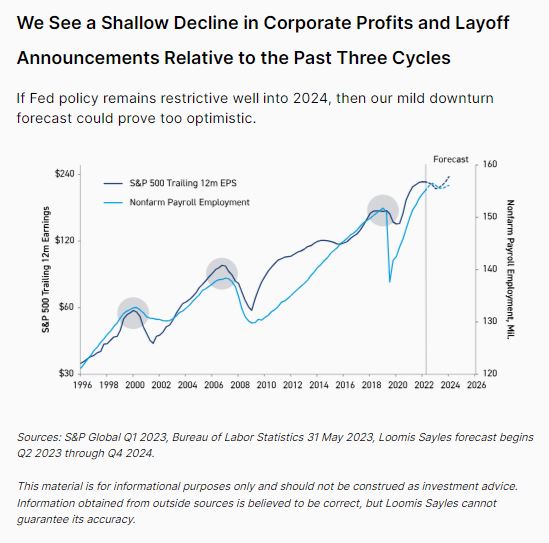

We do not see excessive leverage built up in any one major sector of the economy at present. Instead, rapid central bank tightening appears to be putting pressure on all sectors and slowing economic growth broadly. Over the next six months, we anticipate rising unemployment rates in most countries. We believe the resulting loss of consumption due to job losses would catalyze a downturn.

At this juncture, we believe a mild downturn is ahead. However, we do not know how restrictive monetary policy will become or how long tight financial conditions could last. Strong year-to-date performance across assets suggests a soft landing is occurring. In our view, market optimism may be masking what could be ahead.

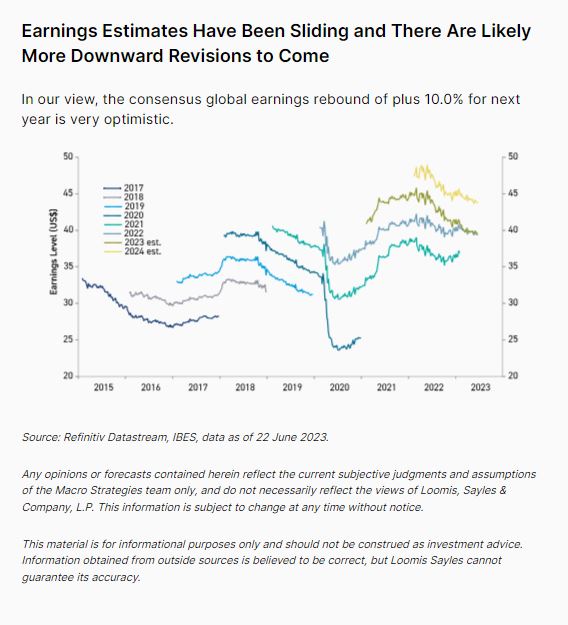

Macro DriversGlobal corporate profits (measured by the MSCI ACWI Index) will likely continue slipping through year-end. The dip has been shallow in recent quarters, but we believe it will deepen throughout the second half of 2023.

|

|

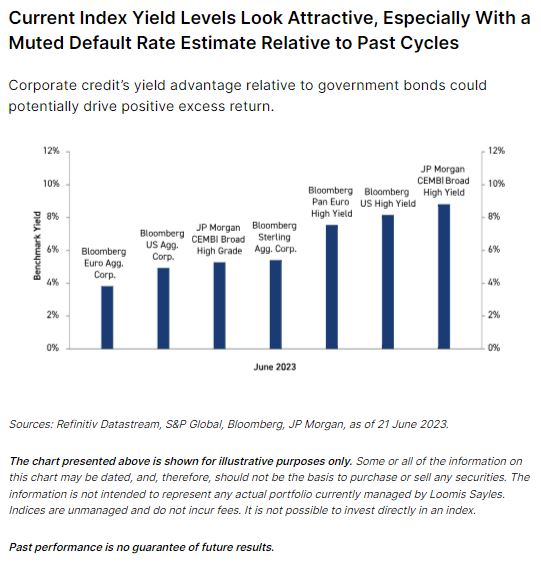

Corporate CreditIn this late-cycle environment, yields on corporate credit benchmarks can be a more accurate representation of market risk than spreads.

1 Our risk premium analysis is based on historical data and does not predict future results. Therefore, the use of this type of information to make investment decisions has inherent limitations. There is no guarantee that future experience will be similar. The analysis is limited to certain periods. We make no representation that the experience of any other periods is comparable. |

|

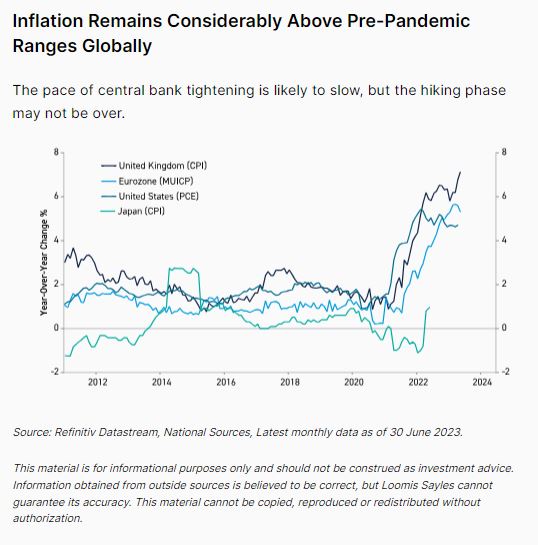

Government Debt & PolicyMarket expectations for central bank rate cuts may prove to be overly optimistic.

|

|

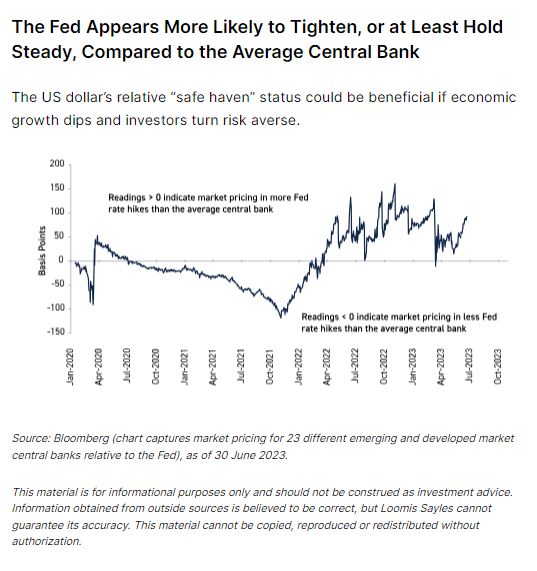

CurrenciesDownturn phases of the credit cycle are most often associated with the US dollar outperforming foreign currencies.

|

|

EquitiesConsensus earnings expectations indicate flat global earnings growth in 2023. We anticipate a modest contraction.

|

|

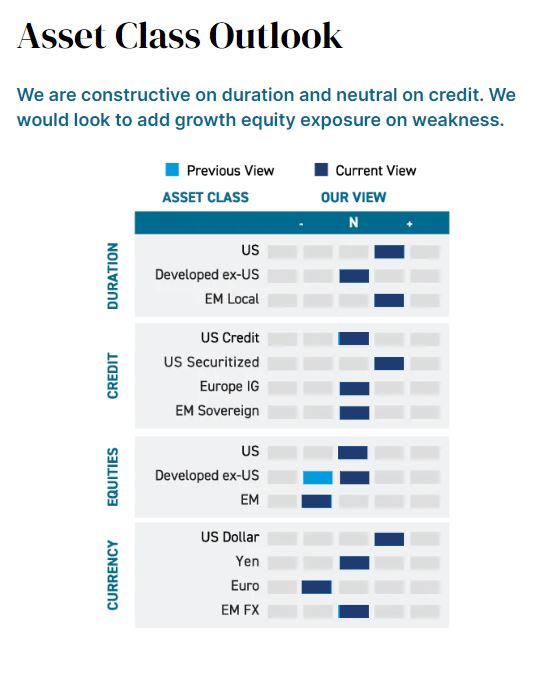

Potential RisksA cautious asset allocation stance with a tilt toward fixed income is warranted in our view given macroeconomic headwinds and a corporate profits recession appearing to take hold.

|

|

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.