Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

Beta, delta, omicron. Each emerging variant of the SARS-COVID-2 virus (the virus that causes COVID-19) sparks some market uncertainty as investors brace for the potential impact. It’s important to pay attention to new variants, but I think investors should plan for a longer-term scenario: a prolonged transition from pandemic to endemic conditions. According to the CDC, endemic viruses maintain a constant presence in the absence of intervention. The common cold is one example. COVID-19 is likely to become endemic, but not until public health agencies can safely lift all interventions. Below, I’ll explain why this process could take a long time and share the potential implications for the global economy.

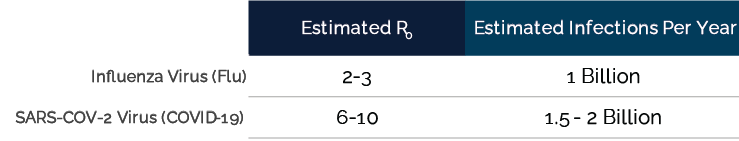

Since COVID-19 burst on the scene, people have compared it to the flu, a common virus endemic to the human population. This table captures how COVID-19 might compare to the flu if all public health interventions were lifted today:

Source: https://www.npr.org/sections/goatsandsoda/2021/08/11/1026190062/covid-delta-variant-transmission-cdc-chickenpox, published 11 August 2021. These estimates were published before the omicron variant emerged. The transmission rate of the omicron variant is not yet known, but is expected to be more transmissible than previous variants.

| The estimated infections seem comparable at first glance, but it’s important to remember that the global population has far more immunity to the flu. Right now, the low level of natural and vaccine-elicited immunity to COVID-19 means that a large percentage of the population is still vulnerable to the virus. Consider how difficult it was to manage the 265 million confirmed COVID-19 cases worldwide during the past two years.[i] This number is far below the estimated 1.5-2 billion annual cases that could occur under normal conditions. Most countries do not have the hospitals, equipment or medical staff to handle the number of COVID-19 cases that could occur after a permanent and successful reopening.

To build public immunity and bring the potential number of cases down to manageable levels, I believe there needs to be a more coordinated effort to increase vaccine access and uptake around the world.

How could the transition impact the economy?In my view, it will take time to achieve the immunity needed for a successful global reopening. I foresee a long transition to endemic conditions, marked by trends and disruptions like these: |

|

During this transition, I believe global growth will remain below full potential, with unevenness among countries due to demographics, vaccine uptake, types of vaccines available, mobility and more. Inflation could continue to surprise to the upside. The Federal Reserve, other central banks and investors may have to recalibrate their expectations accordingly.

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.