Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

The issue of the debt limit, also called the debt ceiling, has moved to center stage. On 1 May, Treasury Secretary Janet Yellen warned that the X-date, the date when the Treasury would not be able to meet all of its debt obligations if the debt ceiling is not raised, could arrive in the first half of June, perhaps as early as 1 June. It is terrible timing, coming on the heels of 14 months of aggressive Fed tightening, a shaky banking industry, a slowing US economy and a world still contending with the Russia-Ukraine war.

Markets will likely get increasingly unsettled as the X-date approaches without resolution. Congress has about four weeks to hatch a deal. Below, I look at five possible scenarios and relate important considerations for each.

Scenario 1: Congress reaches a deal before the X-dateMy baseline view is that Congress will pass a deal at the last minute, perhaps literally so. In politics, each party wants to negotiate a deal on its own terms. They also want to avoid a potential crisis. |

|

Downgrade Odds: Low. I believe a downgrade of US Treasurys would be unlikely in this scenario. However, if the deal does not restrain fiscal spending, rating agencies may choose to downgrade Treasurys to send a message about the trajectory of the public debt. Some may recall that Standard & Poor’s downgraded the federal government in August 2011 despite the fact that Congress passed a deal to raise the debt ceiling and so avoided default.

Potential Market Reaction: We could see a shaky Treasury market and financial volatility as the X-date approaches. The market may also react to the terms of the deal.

Scenario 2: Congress agrees to a short-term extensionTime may be too short to negotiate a deal. Many in Congress were expecting a late July X-date. If time is running short, Congress might pass a short-term extension to push the X-date from early June to late July, giving them time to write the legislation and wrap it up before August recess. In my view, this scenario is little more than a time machine, taking today’s problems and sending them a few months into the future. It is Scenario 1 with a short delay. |

|

Downgrade Odds: Low. I believe rating agencies would wait and watch the next round of negotiations unfold.

Potential Market Reaction: An extension might be market-positive for the short term, but watch for a return to volatility when the limit creeps back up.

Scenario 3: Unconventional challenges to the debt limitPresident Biden may choose to circumvent the debt limit with tactics like declaring the debt limit unconstitutional because it violates the Fourteenth Amendment, or minting a trillion-dollar coin that would be deposited at the Federal Reserve in exchange for cash. I view these as unlikely options. In my opinion, Fed Chairman Jerome Powell probably would not accept a trillion-dollar coin. I believe he wants the debt ceiling lifted by Congress and does not want the Fed to be a battleground between the president and Congress. Moreover, legal battles over such tactics could raise questions about the legitimacy of any new federal debt issue; if the president lost in court, we’d likely be right back where we are now, in my view. |

|

Downgrade Odds: Moderate. I believe rating agencies may choose to downgrade Treasurys over legal uncertainty, even if interest payments remained current. But they might wait to act until the courts have ruled on the legality of the president’s tactics.

Potential Market Reaction: I would expect volatility in this scenario; I do not think markets would like the uncertainty associated with legal challenges or other surprise tactics.

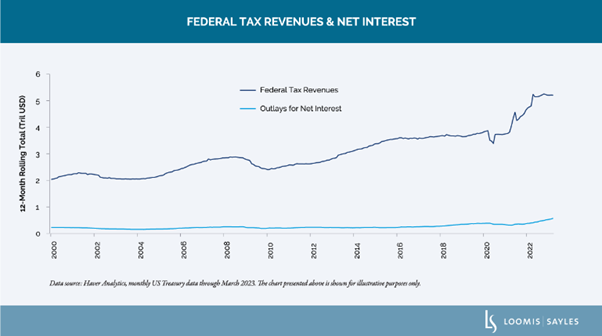

Scenario 4: No deal by the X-date, federal securities servicedThere is a chance that Congress does not reach a deal by the X-date. While it is just a chance, I believe the risks associated with this scenario are significant and should be taken seriously. If the X-date is crossed with no resolution to the debt limit, the Treasury would not be able to meet all of its debt obligations. The federal government would have to go to a balanced budget overnight, spending no more than tax revenues allow, and undergo a partial shutdown. The ongoing flow of tax revenues is ample to fund outlays for net interest (see chart below). The Treasury would need to prioritize payments, choosing which obligations to pay and which to delay. In my opinion, the Treasury can, and likely would, prioritize on-time payments on Treasury securities to avoid default. |

|

In my view, this scenario would have grim economic consequences. The federal government would need to cut spending immediately, halt many important programs and furlough many federal employees. Federal funding to state and local governments would be cut, spreading the austerity to the local level. If this scenario lasted more than a few days, it could lead to serious fiscal contraction—dumped on an economy that is, I believe, already on shaky ground. That could tip the United States into a recession in my view.

Downgrade Odds: High. I believe the rating agencies would downgrade the federal government due to perceived higher risk. However, as long as the Treasury services federal debt on time, I do not think the agencies would declare a default. They are only concerned with sovereign debt; checks for, say, Social Security or food stamps have no bearing on ratings.

Potential Market Reaction: I expect financial markets to go risk off in this scenario. I believe the uncertainty coupled with the fiscal contraction would alarm financial markets and weigh on the US dollar. Moreover, missing important payments for programs such as Social Security would trigger a political firestorm that could unnerve markets.

Scenario 5: Default declaredIn my view, this is a very low-probability scenario, but it’s too serious to ignore. The rating agencies have made it very clear that if the Treasury were to miss even one payment on one security, the federal government will be declared in default. The default would be removed only after all creditors were made whole. Even then, the final result would most likely be a downgrade to the federal government by all rating agencies. The financial and economic impact of a Treasury default, followed by severe downgrades by all rating agencies, is beyond calculation. There is no precedent to guide us. In my view, Congress will do whatever it can to avoid triggering default. |

|

Potential Market Reaction: I would expect the market reaction to be severe, with global impact. Here are just a few possibilities:

A potential wild card is if a crisis emerges that would endanger payments on securities. Consider the recent stress in regional banks and the FDIC’s obligation to insured depositors. The Treasury provides a line of credit to the FDIC. If the public believes that even insured deposits are not safe because the FDIC/Treasury lack funding, we could be in trouble. If it comes to that, Congress might take special actions on the debt ceiling to allow the Treasury to borrow to fund the FDIC.

I expect the next few weeks to be nerve-wracking indeed, but I want to reiterate that my baseline view is a deal before the X-date. I believe Secretary Yellen’s letter made a difference. President Biden has called legislative leaders together for a meeting on 9 May. I believe this is good news: the debate over whether to have a meeting is over. Legislative policymakers can get on with the substance of formulating a debt ceiling package. A tight deadline makes all the difference.

By Brian Horrigan, PhD, CFA, Chief Economist

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement and Target Market Determination, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.