Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

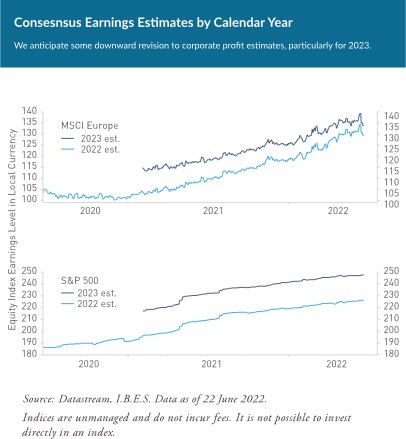

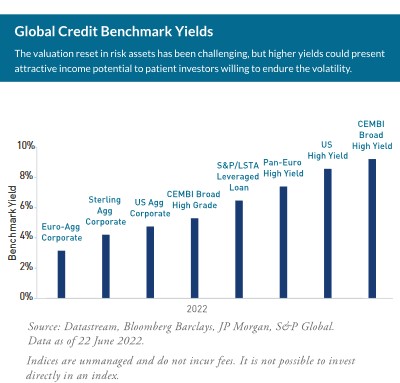

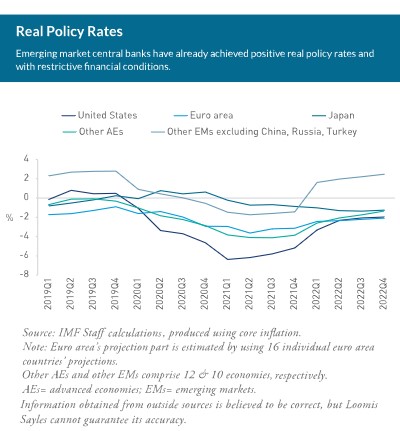

Tighter monetary policies globally, focused on bringing stubborn inflation in line with central bank targets, have increased the odds of a recession. That said, we believe economic elements are in place to sustain the late expansion phase of the credit cycle. Though the market may experience weak profit growth going into 2023, corporate and consumer fundamentals are currently healthy, giving them a favourable footing if the economy shifts. Valuations point to potential opportunities in risk assets—albeit in a volatile environment.

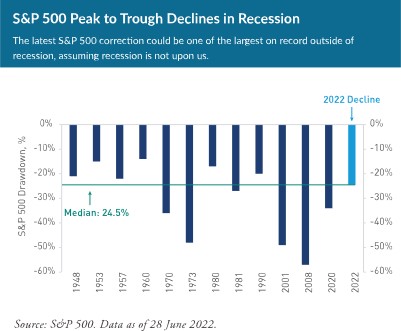

Recession WatchRisk markets appear to be pricing in a significant economic slowdown—not recession.

|

|

Macro DriversStubborn inflation has forced central banks to hike rates despite weakening economic data.

|

|

CreditSpreads may not tighten substantially from here, but we expect carry to persist relative to US Treasurys.

|

|

Government Debt & PolicyWe wouldn’t look for a repeat of the year-to-date spike in yields

|

|

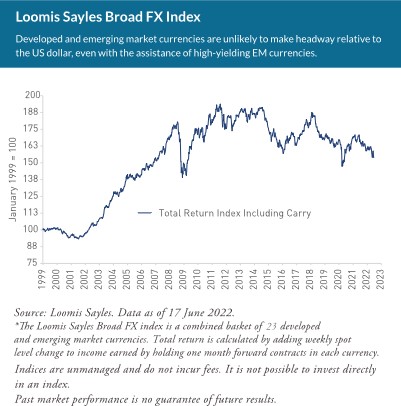

CurrenciesBroadly, we believe FX is unlikely to outperform the US dollar in a risk-averse environment.

|

|

EquitiesUntil inflation trends lower, a lasting equity market bottom and steady uptrend are unlikely.

|

|

Potential RisksExcessive inflation has been driving central banks to tighten despite recession concerns.

|

|

Senior Macro

Strategies Analyst

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement and Target Market Determination, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.