Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

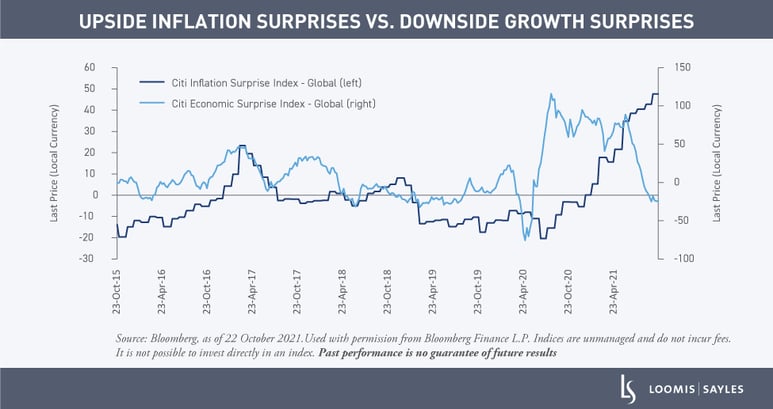

The pandemic triggered economic ripples that have weighed on growth while driving prices higher. In October, the IMF said it expects global economic growth to decline from 5.9% in 2021 to 4.9% in 2022. Unsurprisingly, it cited supply dynamics and COVID-19 variants as contributors to the restrained growth. These same factors also helped foster September’s higher-than-expected, headline inflation.[1]

Does the chart above point to stagflation? No, but it could be transitory “clogflation.” We expect inflation will be transitorily higher as depressed prices normalize and as the prices of supply-constrained sectors surge.

We believe the level of slack in the economy will likely restrain inflation and expect it to return closer to the Fed’s target in the second half of 2022—albeit with plenty of monthly volatility.

Expectations of inflation could rise, turning transitory inflation into sustained inflation. The Fed takes measures of expected inflation very seriously. A “transitory” rise in inflation could get locked into expected inflation. In our view, this could make the Fed’s task of keeping inflation under control more difficult.

The rise in expected inflation may be pushing the Fed to start tapering by end of year. We expect a tapering announcement at the November FOMC meeting. We believe a key to both the economic growth and inflation forecast will be how fast the pandemic can be defeated.

[1] Bureau of Labor Statistics, 13 October 2021.

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.