Global GDP Themes and Forecasts

The disinflation trend appears intact in the US and in the euro area. While economic growth in these regions could ease, we believe solid...

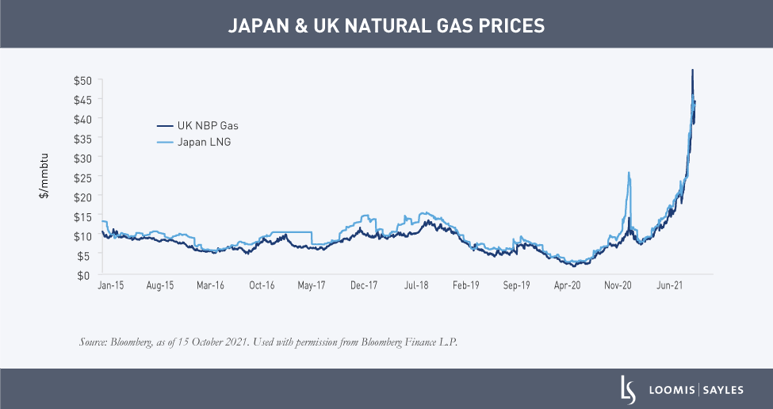

The worldwide spike in natural gas, coal and power prices has put Europe and China at risk of industrial shutdowns. While the situation seems to have surprised the market, it’s been more than nine months in the making. Here’s a look at the factors behind the surge and what could happen next.

How did we get here?

It began with the cold winter in Asia and Europe last year. The weather drained gas inventories to very low levels across the globe. Countries typically rebuild their inventories during the spring shoulder season, but couldn’t this year because of the following reasons:

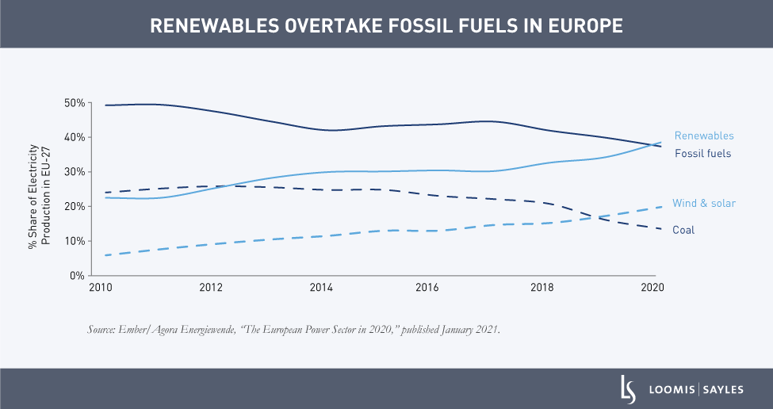

I believe the long-term transition toward renewable energy sources has exacerbated the current situation. Europe and China have reduced their coal generation capacity in favor of renewable energy sources like wind and solar power. However, renewable energy production has disappointed this year, forcing many countries to rely more on natural gas power generation. In my view, if gas inventories reach very low levels and coal is unavailable, some may have to switch to oil-powered generation. However, the ability to do so will be limited. At current elevated prices, I believe it makes more economic sense to burn diesel versus natural gas or coal.

What’s the solution?

In my view, there is no short-term solution to this energy crisis. Even if coal and oil generation facilities come back online, I believe the impact would likely be marginal due to the lack of coal availability and oil generation capacity. I think gas and coal prices will remain high for at least the next year as countries restock inventories and secure supplies for winter 2022/2023.

In the meantime, I believe the best-case scenario is a warm winter that would ease the demand for gas. However, if this winter is colder than normal and renewable energy generation continues to disappoint, we could see significant rationing of electric capacity to industrial facilities in Europe and Asia.

While the market appears to have priced in the direct impact of higher energy prices, I don’t believe it has factored in the potential knock-on effects that the shortage could have on industrial and economic activity. Industrial shutdowns have already begun in China and the UK. If the shutdowns become more widespread, I believe they could disrupt global supply chains (already under stress from the pandemic) and put the global economy at risk of a slowdown.

The information in this article is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and Responsible Entity of the Loomis Sayles Global Equity Fund (‘Fund’). Loomis Sayles & Company, L.P. is the Investment Manager. This information should not be relied upon in determining whether to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the Fund’s Product Disclosure Statement, available on the website www.loomissayles.com.au or by contacting us on 1300 157 862. Past performance is not a reliable indicator of future performance. Investments in the Fund are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Fund or any particular rate of return.

Register to receive regular performance updates and regular insights from the Loomis Sayles investment teams, featured in the Natixis Investment Managers Expert Collective newsletter.

Loomis Sayles marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Loomis, Sayles & Company, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.